Just to be clear, insurance documents and endorsements might be challenging to read. The main reason insurance policies are complex to comprehend is that they are legal documents created and analyzed by “legal-minded” individuals.

Although we refer to these agreements as “policies,” they are legal contracts that must adhere to precedents and contract law.

Additionally, “standard” policies have been produced, amended, and rewritten throughout the years, such as those published by the Insurance Services Office (ISO) and the American Association of Insurance Services (AAIS).

Combining language in its ancient and new forms may sometimes lead to misunderstanding. The pollution exclusion in the business general liability coverage is a prime example (f.).

It is simple to identify areas where the new language was inserted without addressing the organization of earlier or existing text when comparing the historical evolution of the exclusion to the present wording.

In essence, the inclusion of exclusionary and exception language has resulted in a lag in the usage of conjunctions and punctuation.

The outcome is a patchwork that can cause misunderstanding, particularly if the person reading and interpreting the exclusion is picky about language and punctuation.

What Exactly Is An Insurance Policy?

The insurance firm (the insurer) and the person(s), corporation, or other entity being covered have a legal agreement called an insurance policy (the insured).

By reading your policy, you can make sure that it addresses your requirements and that both you and the insurance provider are aware of your obligations in the event of a loss.

Many insureds obtain a policy without fully understanding what is covered, what is excluded from coverage, and what requirements must be satisfied before compensation will kick in in the event of a loss.

You can start borrowing money if your conditions of insurance policy is not properly drawn up. In order not to seek help from the best credit card consolidation loans read carefully and learn to understand your policy.

The Foundations Of An Insurance Agreement

An contract has the following fundamental insurance policy components:

- Page of Declaration

- Insuring Agreement

- Exclusions

- Conditions

- Definitions

It’s critical to be aware that multi-peril plans could have certain limitations and requirements for every kind of coverage, including collision coverage, medical payment coverage, liability coverage, and others.

The text of the particular coverage that relates to your loss must be reviewed carefully.

The Declaration Page

This is often the opening page of an insurance policy. The insured, the dangers or things covered, the policy limits, and the duration are all specified.

For instance, the details of the car covered (such as the make, model, and VIN), the name of the person insured, the premium amount, and the deductible will all be included on the Declarations Page of an automotive policy (the amount you will have to pay for a claim before an insurer pays its portion of a covered claim).

The name of the insured individual and the policy’s face value will also be included on the Declarations Page of a life insurance policy.

The Insurance Contract

There is a list of what is covered as well as a description of the primary assurances offered by the insurance provider.

The insurer commits to several actions under the Insuring Agreement, including paying damages for covered dangers, providing certain services, or committing to defend the insured in liability litigation.

There are two fundamental types of insurance contracts:

- Under named-perils coverage, only the risks that are specifically stated in the policy are protected. If the risk is not specified, it is not covered.

- All-risk insurance covers all damages, except those that are specifically excluded. If the loss is not excluded, it is covered. Full-risk plans are the norm for life insurance policies.

The Exclusions

Exclusions void the Insuring Agreement’s coverage.

There are three main categories of Exclusions:

- Omitted risks or sources of loss

- Absent losses

- Excluded assets

Some dangers that home insurance does not cover include floods, earthquakes, and radioactive radiation.

One such example of an excluded loss under vehicle insurance is wearing and tear damage. Excluded property under home insurance includes things like a vehicle, a pet, or an airplane.

The Conditions

Conditions are provisions in the policy that limit or qualify the insurer’s duty to pay or provide services. If the insurance’s requirements are not met, the insurer may deny the claim.

Common policy requirements include being required to provide the insurer evidence of loss, to protect property after a loss, and to cooperate with the insurer during an inquiry or the defense of a liability claim.

Definitions

Most rules define specific terms that are used within the policy in the Definitions section. It could stand alone or be a subsection of another section.

To fully understand the language used in the policy, you must read this section.

Included In Your Papers Are Keywords And Phrases

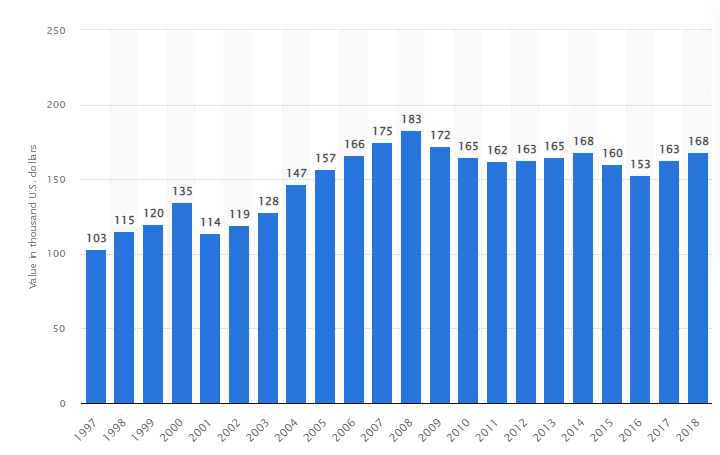

In 2018, Americans insured their lives for a total of $168,000. Each of them had to learn all the subtleties of insurance.

Average face amount of individual life insurance policies purchased in the United States from 1997 to 2018

While there is industry-specific jargon used in the insurance sector. Any or all of the following information might be included on your certificate of insurance:

- Assurance number: you’ll need this each time you modify your insurance or file a claim.

- Both the start and end dates: these dates specify the beginning and ending dates of your coverage.

- By underwritten: a different word for “insurer” or “insurance firm.”

- Insured: your name; the insurance company and you are parts of an insurance contract.

- Further designated insured: the name of a co-owner who shares your rights in a car or piece of property.

- Legal responsibility: you’ll often notice a coverage maximum of $1 million or $2 million; this protects you from financial liability if you inadvertently cause someone else’s property damage or physical harm.

- Premium: your insurance plan’s price.

- Endorsement: an endorsement is an addition or modification to an insurance policy, often known as a rider. The coverage in the basic contract may be amended by endorsements by addition, deletion, exclusion, or other means.

- Assurance item: the subject matter of an insurance policy. Your home’s contents, your automobile, your house, or a specialized item like a boat or travel trailer might all be considered personal property.

- Personal items scheduled: you’ve mentioned several insured products that are covered for a larger maximum than the regular insurance does, often because they are exceptionally expensive objects like jewelry, electronics, or fine arts. Scheduled personal property is covered beyond what is typically covered by a homeowner’s insurance.

Bottom Line

Some individuals say they like reading insurance policies. The person who sells you insurance, however, should be.

Since the likelihood that you may be the subject of a claim at some point is high, don’t put off taking the time to learn how to read insurance coverage can be used to pay for risk occurrences in the future that you were unable to prevent.

Articles You Might Be Interested

Smart Strategies for Affordable Vehicle Insurance